Potential areas to find points of support and resistance based on the idea of freely volatility is expected in the pair, has historically had begun in the "dig" futures contracts as a quick way to search for opportunities to open and close deals during the deliberative session. There are people who are discovering the focal point on the long-term time frames, but every time you meet, it is almost always on the agenda short frame. In fact, there is a short-term traders do not use only the focal points.

Some platforms support the focal points that have been used, but a deliberative platform not supported, you can easily calculated and put in place. For traders of you who use the platform "MetaTrader 4" (MT4), there is a lot of indicators that are available for installation on the forums deployed in the Internet, which will calculate these points automatically, and some brokers also provide the tools you this.

How do you calculate the focal point?

Pivot levels are calculated using 3 types of information from the previous day deliberative:

The highest price.

The lowest price.

Closing price.

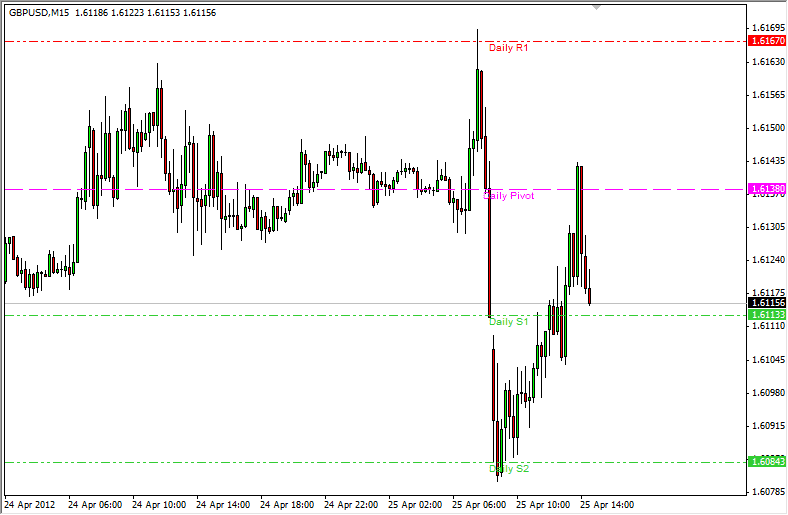

It is clear that in order to find the high price and low and closing price of the previous day, all you have to do is to look at the candle from the previous session. Many of the traders put the focal point of these three prices on shorter time frames, such as spreadsheets and time tables fifteen minutes. Can be focal points that will tell you when the market falls and changes direction with a short period of other traders to follow them for the near future.

For the calculation of the focal points of this, you should use the following equation:

The focal point = (yesterday's high + close yesterday + yesterday's low) / 3

Resistance 1 = point (fulcrum × 2) - a decrease of yesterday.

Support 1 = point (fulcrum × 2) - high yesterday.

Point Resistance 2 = focal point + (yesterday's high - yesterday's low).

Support 2-point fulcrum = - (high yesterday - yesterday's low).

These areas of possible support and resistance during short-term markets, which could guide the deliberative today. Often, traders will always use something like candles in order to confirm the reactions that can occur when these areas as well.

As can be seen how these points can be regarded as "instructions" good direction with respect to which it is possible to move the market and have a reaction towards him. But, that is referred to as the focal point should be part of the system, and not the whole system.